To help achieve the EU’s 55% target for 2030 and 0 in 2050, the EU has determined that the EU Emissions Trading System for industry, energy, air and maritime shipping (ETS-1) will get a little brother as of 2028: ETS-2. This includes CO2 emissions from the combustion of fuels in traffic and for heating and cooling in buildings. And countries may also add other sectors where fossil fuels are burned, the so-called ‘opt-in’ sectors like smaller SMEs, fuel used on farms, domestic ships etc. February 18, the EU Council adopted its position on a targeted amendment of the market stability reserve ETS-2 to ensure a smooth start in 202i8

The ETS-2 Cap for 2028

A separate CO2 budget has been agreed for ETS-2, which will be reduced annually from 2028 by more than 5.15-5.43% per year to -42% in 2030, compared to 2005 and to zero around 2044. Dec 3, the European Commission defined the total allowances for 2028 at 1 bln CO2 (=average CO2 emissions from fuel combustion in ETS2 sectors 2016-2018 minus reduction path for Effort Sharing Sectors, minus annual linear reduction factor for the years 2025-2027, 5.1%).

The CO2 budget for national ‘opt-in sectors’ (see below) will be decided later, based on their average national emissions in 2016-2018.

To prevent motorists and tenants from incurring excessive costs, a number of safety buttons and funds have been built into the system

Covered entities of ETS-2

Participants under ETS-2 are usually the same entities as those that pay the excise tax on energy and mineral oil, baded on te Energy Taxation Directive. In the whole EU around 10,000 entities: 7000 tax warehouses for oil, 1400 gas suppliers, 3000 for coal. For fuel suppliers under ETS-2 with less than 1,000 tonnes of CO2 emissions per year, a simplified procedure for monitoring and reporting will be applied.

Covered fuels of ETS-2

Besides products intended for use as motor fuel as mentioned in the Energy Taxation Directive, and also that are used as additives or fillers in motor fuels. Further a all other hydrocarbons (except peat) intended for use as heating fuel. In addition, biofuels fall under EU ETS-2, but can be reported with an emission factor of 0 if they meet the criteria of the Renewable Energy Directive (RED3).

ETS-2 ‘Opt-out’

States can ask ‘opt-out’ of the ETS-2 implementation until ultimately 2030, if they have a carbon tax applied to the fuel suppliers, that is equivalent or higher than the average ETS II price. The EU Commission will review this every year. And if the ETS-2 price is higher than the national carbon tax the derogation ends. That is why in the meantime the CO2 emissions will have to be monitored and reported by suppliers. There is no need to buy allowances and pass through CO2 cost to consumers. Ireland and Norway asked so-called derogation from ETS-2. Their current carbon tax is 56 Euro respectively 100 Euro per ton CO2e. There is no final decision yet.

ETS-2 ‘Opt-in’

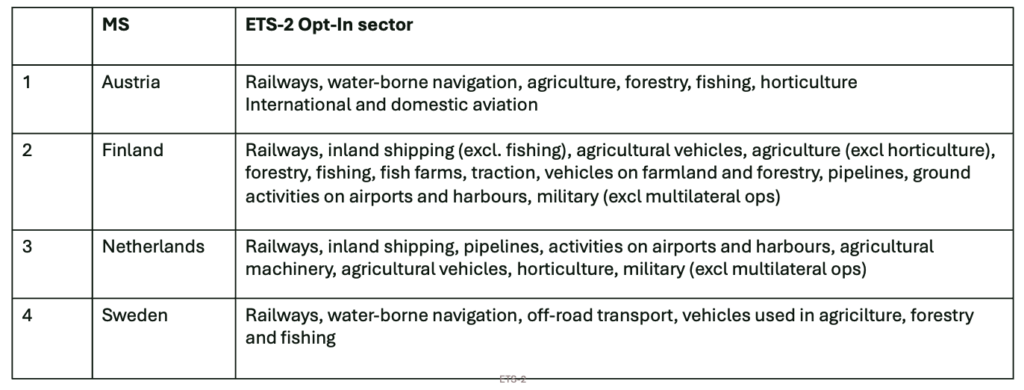

Several EU member states use the opt-in opportunity as broadly as possible to include more emissions sources under the ETS cap (see table). This means that fuel suppliers who supply fossil fuels to those sectors must also monitor and avoid the emissions and /or purchase emission allowances.

Which sectors do member states opt-in: see table. Additional country opt-ins may be requested in the near future. Most countries still need to adopt national legislation to implement ETS.

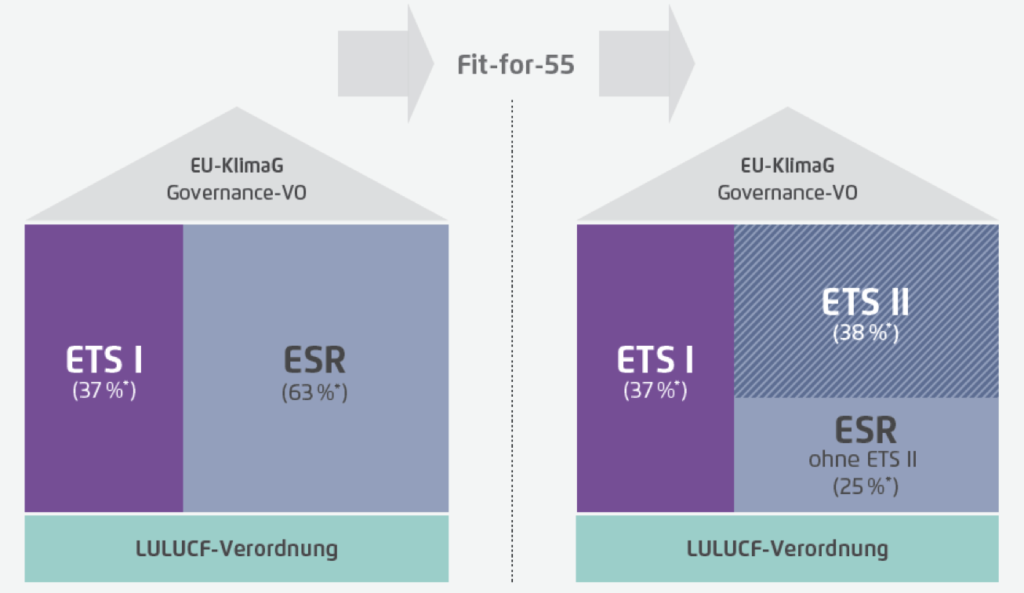

Overall Coverage

Some 63% of overall EU CO2 emissions will then fall under ETS-1 and ETS-2. Including the ETS-2 opt-in, will bring it to around 75%. Not included are, other and smaller ESR emissions, methane and hydro-fluorocarbons, and N2O. Besides this, there are emissions that fall under the land use sector (LULUCF) with a specified CO2 target of removing 310 Mton by 2030.

Fit-for-55-Paket”, Agora Energiewende (2023)

Upstream system

ETS-2 is a so-called ‘upstream system. This means that ETS-2 does not include the end users of the fuels, where emissions occur, but the fuel suppliers. The CO2 pricing stimulates suppliers to produce cleaner fuels for mobility (biofuels and recycled fuels that meet RED3, e-fuels, hydrogen) or to invest in electric transport or in sustainable heating and cooling networks and green gas, for example. And the EU renewable energy targets and the Energy Performance of Buildings Directive help decarbonize these sectors.

Scope-3 emissions

The scope of ETS-2 is actually covering the indirect CO2 emissions, ‘scope-3’, of the petrol and diesel producers and of the gas and fossil heat suppliers. These are the ‘regulated entities’ that, under ETS-2, must purchase emission allowances to cover the emissions by burning them in cars and buildings.

In the recent judgment in the Netherlands’ court case of Milieudefensie against Shell, the Court of Appeal said it could not apply the requested general -45% in 2030 for all companies, sectors and scopes the same way. It referred to the reductions that EU has already achieved and will achieve via ETS-1 (-62%) and ETS-2 (-42%) in 2030, meaning ETS-2 can indemnify companies against specified scope-3 targets.

Implementation

The ETS-2 permit requirement will come into effect on 1 January 2025; the emission report by fuel suppliers for 2024 must be submitted on 30 April 2025. In 2027, the additional emission allowances will be allocated to the member states’ op-in sectors based on their average historical emissions. Frontloading auctioning will take place from 2027. In May 2029 the allowances must be surrendered for the emissions from 2028.

Participants can buy ETS-2 emission allowances (EUAs) at the EU ETS auctions and the carbon market. No free allowances are distributed. The ETS-2 allowances are not interchangeable with ETS-1 and have their own CO2 price. In 2031, the European Commission will examine in 2031 whether ETS-1 and ETS-2 can be linked.

Early trading futures possible

- The Intercontinental Exchange (ICE) will launch its first series of ETS-2 future contracts (“EUA 2s”) May 6. 2025 to allow taking positions early and for price disclosure. The first five contracts will expire in December 2028, April 2029, December 2029, April 2030 and December 2030.

- The European Energy Exchange (EEX) launched EEX EU ETS2 Futures July 7, 2025.

How is ETS-2 similar to ETS-1 and how does it differ?

The similarity is that both have a decreasing CO2 budget to 0 and that there is a price on CO2 emissions. The big difference is that ETS-2 is an upstream system. This means that if the CO2 reductions do not decrease quickly enough, the CO2 costs increase and can be passed on to the tenant and motorist. According to market analyst Veyt, an additional 55 Mt CO2 reduction per year will be needed in the sectors concerned to achieve a 5% reduction per year. Currently, this reduction is just 4.4 Mt with the use of water pumps and 5 Mt per year with electric cars. All ETS-2 allowances will be auctioned, no free allocation, separately from ETS-1 allowances.

ETS-2 CO2 Pricing

Another difference is in the CO2 pricing. In ETS-1, the marginal CO2 price was partly determined by the fuel switch price from coal to gas and now by the CCS cost. For ETS-2, the marginal CO2 price is much more diffuse and determined by various technologies and national support. This separate ETS system has been agreed for mobility and the built environment in order to stimulate investments there and because the marginal costs are currently estimated to be higher there than in ETS-1.

Whether ETS-2 will be effective in achieving CO2 targets remains to be seen. CO2 reductions in mobility and the built environment, and the supporting renewable power network and energy performance of building are lagging behind. And if there is too little supporting government policy, and the EU Social Climate Fund is not used, there is a good chance that tenants and motorists will be faced with high energy costs

Price Mechanism and Safeguarding Market Stability

ETS-2 aims to prevent costs for tenants and motorists from becoming too high. The ETS-2, in order to limit the CO2 price risk, there are a number of buttons and a fund to control cost increases for mobility and the built environment:

- The auction of ETS-2 allowances will start with ‘frontloading’ for the first 17 months. So 30% extra allowances will be auctioned earlier, thus 130% of the 2028 Cap mentioned above, to limit the price. Thus, 1.3 billion emission allowances will be auctioned in 2028 a surplus of approximately 250 Mt. The additional 30% will be deducted from the auction volumes for the years 2029-2031.

- There is a price mechanism extending after 2030. The European Commission wants to keep the price at €48 (€57 2025 level) per emission allowances in the beginning. That amounts to approximately 10 cents more per m3 of gas. For a liter of petrol 20 cents extra and for a liter of diesel 13 cents.

If the auction price is higher, the European Commission will auction 40 Mton extra allowances from the 600 Mton Market Reserve. This release can be triggered twice per year. This means that up to 80 million additional allowances can be injected into the market annually. - Market Stability Reserve: when the number of allowances circulating on the market (TNAC) falls to 210 Mton, 100 million allowances are released from the market stability reserve. If the number of allowances drops below 260 Mton allowances, but still above 210 million, a lower number of allowances will be released.

- Prior to the start of ETS-2, the Social Climate Fund will be available for the EU in 2026 up to 2032: 86.7 billion euros for residents and motorists with 25% co-financing from the Member State. The fund is for measures intended to contribute, for example, to the decarbonisation of heating and cooling of buildings or the reduction of the energy needs of buildings, the integration of renewable energy sources, in home and neighborhood batteries and in manure fermentation for green gas, etc. It can also involve financial support for low-income households in the worst performing buildings or a reduction in excise duties.

- Besides the Fund, Member States will have revenues from ETS-2 auctioning. They are mandated to allocate this towards climate and social purposes. The revenues are estimated to be at least €280 bln between 2027 and 2032. If ETS-2 prices indeed peak, there is also more funding available to avoid or compensate cost at demand side.

Complementary EU and national policy and use of Social Climate Fund needed

It is clear that in order to help achieve the CO2 targets of ETS-2, while at the same time limiting the costs for tenants and motorists, enough progress and availability of renewable electricity on the grid, clean fuels, sales of EVs, energy performance of buildings, reaching renewable energy targets (49% in buildings in 2030 and 0,8%/yr nationally by 2026 and with 1,1%/yr up to 2030).

And additional national policies are needed:

- In France they are considering support for subscriptions for second hand electric cars.

- In the Netherlands subsidies for EVs ended, but support to share second hand EVs is a possibility. It is also considering supporting or requiring a minimum percentage of green gas for ETS-2 sectors. And power for heat networks for buildings can be given priority on the electricity grid.

- Austria on the other hand will abolish its ‘Klimabonus’. That was ranging from subsidies for green heating systems to compensation for commuting by bike. That could have limited the cost for motorists and tenants.

- The new Belgium government agreed a social lease for EVs and lowered the VAT on heat pumps from 21% to 6%.

Risk of high future CO2 ETS-2 costs

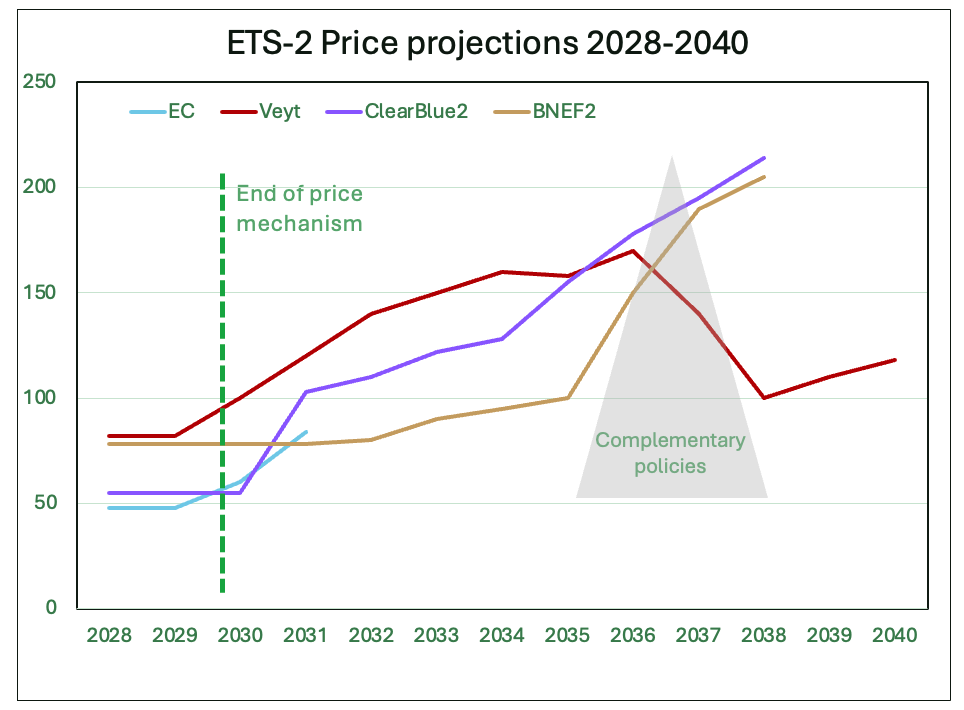

The combination of bringing forward the auction of emission allowances (‘frontloading’) and more scarcity later and the uncertainty whether there is sufficient supporting policy in the Member States (‘Low’ and ‘Limited Complementary Policies’ in the graph above) means that the projection of the CO2 price in 2030 and thereafter is very uncertain, but that there is a great risk of a high CO2 price. The European Commission expected a CO2 price of 68 euros in 2030. But various market analysts and researchers predict a CO2 price between 150 and 300 euros in 2030 (50-100 cents more per liter of diesel) and between 250 and 400 euros in 2040 in the absence of additional policy: the less complementary policy, the higher the CO2 price (see graph).

Conclusion

Whether ETS-2 will be effective in achieving CO2 targets remains to be seen. CO2 reductions in mobility and the built environment are lagging behind. And if there is too little supporting government policy, and the Social Climate Fund is not used, there is a good chance that tenants and motorists will be faced with high energy costs.